Ever wondered how Singapore could create more living space despite being so small? The answer might be looking up—literally. A game-changing policy review is set to relax building height limits near Singapore’s airports and airbases, potentially creating exciting new investment opportunities in these areas.

This could be one of the most significant property market shifts in recent years for investors like you. With residential buildings potentially growing up to 15 storeys taller and commercial buildings up to 9 storeys higher, the investment landscape around Singapore’s airports is about to transform.

Have questions about how these changes might affect your investment strategy? Reach out via WhatsApp at 6593466787 for personalized insights.

Understanding the New Height Restriction Changes

The International Civil Aviation Organization (ICAO) and Civil Aviation Authority of Singapore (CAAS) have reviewed building height restrictions near airports. The results? A significant relaxation that could transform Singapore’s property landscape starting this August.

Here’s what you need to know in simple terms:

Think about what this means: a property that was previously limited to 14 storeys could now potentially reach 29 storeys. That’s not just a small adjustment—it’s a complete reimagining of what’s possible in these areas.

Key Neighborhoods Affected by the Height Changes

The new height restrictions will impact areas surrounding Singapore’s two airports and four military airbases. If you own or are considering investing in property in these neighborhoods, pay close attention.

Near Changi Airport:

Near Seletar Airport:

Wondering if your specific property falls within these zones? Send us a message on WhatsApp at 6593466787 with your address, and we’ll help you determine if it’s affected by the new regulations.

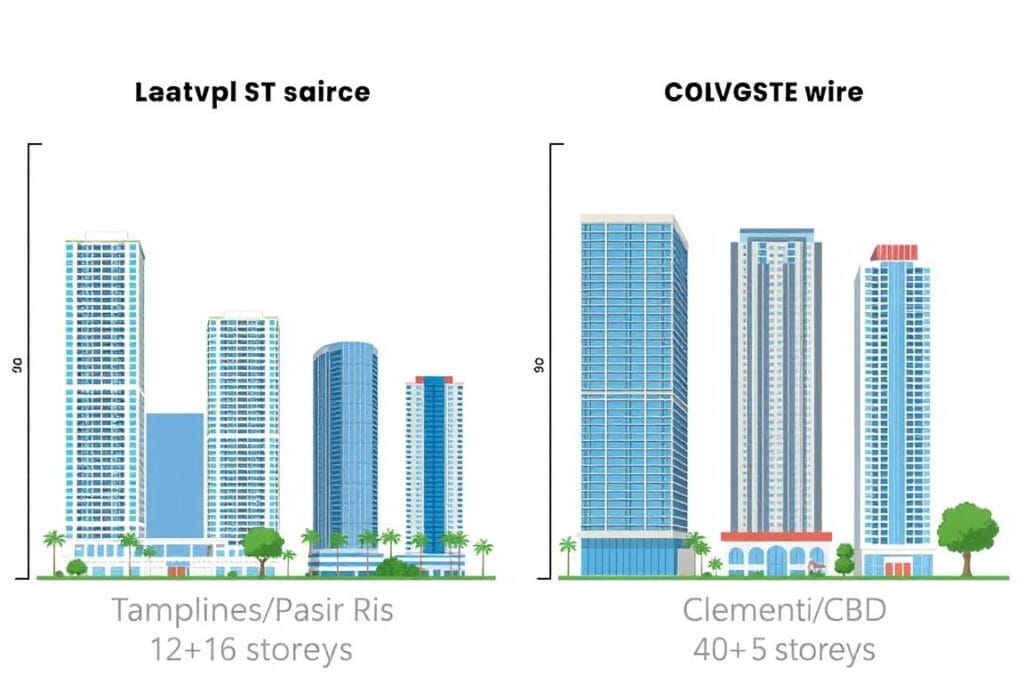

Current Height Variations Across Singapore

To understand the impact of these changes, it helps to know the current height limits in different parts of Singapore. Right now, there’s quite a range depending on where you are.

| Area | Current Typical Height | Distance from Airport |

| Tampines | 12-14 storeys | Within 4km of Changi |

| Pasir Ris | 14-16 storeys | Within 4km of Changi |

| Punggol/Sengkang | 14-16 storeys | Near Seletar |

| Clementi/Queenstown | 40+ storeys | Far from airports |

| Central Business District | Up to 305m | Far from airports |

As you can see, buildings in areas like Tampines and Pasir Ris have been limited to around 12-16 storeys due to their proximity to Changi Airport. Meanwhile, areas further from airports like Clementi can reach over 40 storeys under the 150m height limit.

With the new changes, those areas near airports could see dramatic increases in allowable height—potentially closing the gap with other parts of Singapore.

Why These Changes Matter for Your Investment Strategy

These height restriction changes aren’t just interesting news—they could significantly impact your property investment returns. Here’s how:

Investment Advantages

Considerations

Think of it this way: if a developer can suddenly build 15 more floors on the same piece of land, that land becomes much more valuable. For existing property owners in these areas, this could mean significant appreciation in asset value.

Got Questions About Your Property’s Potential?

Our team can help you understand how these changes might affect your specific property or investment plans. Reach out for a personalized assessment.

Case Study: Elias Green in Pasir Ris

Let’s look at a real example to understand the potential impact. Elias Green, a condominium in Pasir Ris near Changi Airport, recently attempted an en bloc sale with a guide price of S$928 million. The tender closed in April with no bids.

Currently built up to 16 storeys on a parcel with a plot ratio of 1.4, the owners submitted an application to increase the plot ratio to 1.8. With the new height relaxation, this application might now be viewed more favorably by authorities.

What does this mean in simple terms? A developer who previously couldn’t justify the S$928 million price tag might now see value in it because they could potentially build:

This pattern could repeat across many older developments near airports, potentially triggering a wave of successful en bloc sales after a relatively quiet 2024 (only 4 successful deals out of 16 properties on the market).

En Bloc Sales: How Height Changes Could Revive the Market

The collective sales (en bloc) market has been quiet lately. In 2024, only four out of 16 properties put on the market were successfully sold—half of 2023’s activity. The new height restrictions could change this dramatically.

Here’s why en bloc potential increases with these changes:

As CBRE’s Tricia Song explains (in simpler terms): “If you can build more gross area on the same piece of land, there’s more value in selling for redevelopment than in the secondary market.”

Wondering if your property might be a good en bloc candidate? Message us on WhatsApp at 6593466787 for a quick assessment.

Important Considerations Before Investing

While the potential is exciting, there are some important factors to consider before jumping into investments near airports:

Key Points to Remember:

As Knight Frank’s Alice Tan notes, private sites with “low development baselines” might not support higher plot ratios given current high LBC rates. In simple terms, just because buildings can go higher doesn’t automatically mean every property will benefit equally.

The CAAS has stated that agencies will assess the implications of these revisions, considering other infrastructure and planning factors. This means implementation might vary across different areas.

Is This the Right Time to Invest Near Singapore’s Airports?

With these upcoming changes, areas near Singapore’s airports could see significant property value increases in the coming years. The ability to build higher means more efficient use of land—a precious commodity in land-scarce Singapore.

For investors, this presents several opportunities:

As Savills’ Alan Cheong puts it, “Any new launches or resales in the area will price in the future growth potential.” This means early movers might benefit most from these changes.

Ready to explore your options for investing near Singapore’s airports? Our team specializes in identifying high-potential properties in these areas. Contact us on WhatsApp at 6593466787 to discuss your investment goals.

Frequently Asked Questions

Which neighborhoods will benefit most from these height restriction changes?

Areas closest to Changi Airport like Pasir Ris, Tampines, and Bedok are likely to see the most significant impact. Near Seletar Airport, neighborhoods like Yishun and Ang Mo Kio could also benefit substantially. Properties currently at their maximum height limit with redevelopment potential will see the greatest advantage.

When will these changes take effect?

The changes are set to take effect internationally from August 2025. However, local implementation may take additional time as government agencies assess implications and develop specific guidelines for different areas. Contact us on WhatsApp at 6593466787 for the latest updates.

Will all properties near airports automatically increase in value?

Not necessarily. While the potential for increased development intensity exists, actual value increases will depend on factors like current height versus new allowable height, redevelopment potential, land betterment charges, and market demand. Older developments with en bloc potential are likely to benefit most.

Are there any downsides to investing near airports?

While the investment potential is significant, properties near airports may still experience some aircraft noise (though modern buildings have excellent soundproofing). Additionally, implementation of the new height rules may take time, and not all properties will benefit equally. It’s important to research specific locations carefully.

Got Questions About Airport-Area Investments?

Our team specializes in identifying high-potential properties near Singapore’s airports. With the upcoming height restriction changes, now might be the perfect time to explore your options.